Foresight Financial Planning was founded in 1990 with a singular vision to help ordinary individuals fulfill their financial dreams and feel confident about their future.

Throughout our long journey, we’ve always put our clients’ needs first and helped thousands of people invest for what’s important to them.

Every day – we work with our clients one-to-one, to help put their dreams and goals more within reach.

Know your financial plannerKnow your product advisor

Anil Gaur

Anil Gaur, CERTIFIED FINANCIAL PLANNERCM, has over 37 years of experience in the financial services industry. (CFPCM is recognized and respected as the most prestigious and internationally accepted Financial Planning qualification).

He has a passion for empowering individuals through financial education and coaching.

While taking into account the behavioral and psychological limitation of investors, he proactively educates them about the right path to wealth creation while handholding them through the noise, in order to avoid investing mistakes.

His belief that investors across sections are often misguided and need serious financial advice got firmed up during the global financial crisis in 2008-09. He took the challenge then, and quit a promising managerial job in a public sector bank to setup his very own financial advisory firm, when many others were leaving this space.

He has also been trained by ‘George Kinder’, the world renowned ‘life planner’ on ‘Seven Stages of Money Maturity’, and can now provide solution to investors with the innovative approach that integrates money with life.

A firm believer in the fundamental principle of wealth building: “It’s not what you make, but how you manage it.”, he finds great joy and a sense of purpose in simplifying the complex world of investing and helping investors find the ever elusive balance between living in the present and saving for the future.

Sudha Gaur

Sudha Gaur is AMFI and NISM certified and has 27 years of experience in the financial services industry.

Sudha started her career in the world of finance in 1990 with the Distribution of UTI and various bank sponsored Mutual Funds. She has also been active in supporting the investors with Company fixed deposits and small saving instruments such as PPF etc. and has served thousands of clients for their various investing needs. She has gained tremendous goodwill and trust of her clients by helping them with the most appropriate investment products and simplifying their investment decisions.

She does not encourage any product bias as she strongly believes in the principle of “Client first, product next”. She is also a volunteer for the women focused financial awareness clinics sponsored by DSP Blackrock Asset Management Company.

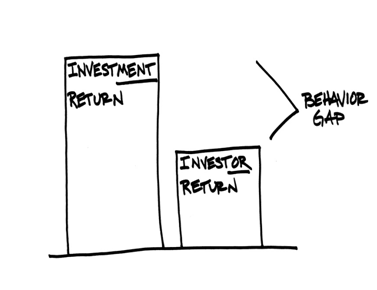

As per various research reports published throughout the investing world, average investors have grossly underperformed the financial markets.

This gap is due to high taxes and expenses, emotional investing, lack of diversification and lack of discipline etc.

We attempt to bridge this gap with honest handholding of investors through various stages of their investments.

1. We do not try to please everyone:

Attempting to be something to everyone usually results in loss of focus .Choices are not dictated by latest fad or opinion. Our approach may not appeal to investors who are seeking quick fix - shortcuts or excitement through investments.

Our preference for sticking to old fashioned ethics might look boring, but we will never sacrifice prudence.

2. We strive to educate you before you invest:

We believe in investor empowerment through educating. We ensure that you get comfortable with our style of money management that truly helps you achieve what you come to us for. We are convinced that it is worthwhile to invest time and efforts in ensuring that we serve the right people.

3. We see Ourselves as advocate of clients and not product peddlers:

We are clear that our primary objective is to maintain our clients’ trust, not merely selling products. That is why we do not have a sales team, only the supporting staff for providing investment assistance. We are also convinced that happy investors can become our brand ambassadors.

4. Our beliefs guide our actions:

We believe in simplifying the investment process and do not confuse the investors with product bombardment or information overload. The manner in which we manage our client’s money reflects this.

Our Vision

Knowledgeable, Well-informed, Smart and Successful Investors

Our Mission

Helping and Empowering Investors with Hard Facts & Unbiased Opinion

In advising, The ‘Heart’ (Empathy) Comes before ‘Head’ (Expertise)